Credit card processors handle the complexities of credit and debit card acceptance for the vast majority of businesses. Clients may easily and quickly pay with their credit cards thanks to credit card processing, which is a crucial service.

In order to have a basic understanding of credit card processing, read the following introduction.

How does one go about processing a credit card?

A customer must first and foremost provide their credit card details in order to be reimbursed for their purchase(s). Customers can pay for their purchases in-store using a variety of methods, including magnetic stripe cards, EMV chip cards, contactless cards, and digital wallets like Apple Pay. In order to make purchases on websites and applications, customers must use payment processing gateways to process their credit and debit cards. Telephone orders can be processed using a virtual terminal that can be accessed from a personal computer.

The processor receives the payment information, which is then transmitted to the customer’s bank via the relevant card networks, as previously explained (such as Visa or MasterCard). Customer’s financial institution approves or denies the transaction.The legality of the card number and the availability of adequate cash are among the factors that must be verified before an application may be approved.

To complete the transaction, you must first have your payment processor return the information to your payment terminal or credit card reader. Unless otherwise noted, all transactions that have been approved for settlement are collected at the end of each business day. Your merchant account receives deposits as a result of charges made to your customers’ accounts.

When Choosing a Credit Card Processor, What to Consider?

Many moving parts, growing technology, payment networks, regulators, and financial institutions are involved in the process of accepting credit cards. There is a wide range of quality variance among credit card processors, as there is with any service of this complexity.

In your search for credit card processors and merchant acquirers, be careful to inquire about the following four critical aspects of payment processing quality:

- Reactivity in a transaction

- A record of near-perfect uptime

- That which is reasonable and transparent in terms of fees.

- Friendly and helpful customer service

Transaction speed is an important factor to consider

Customers appreciate the ease of using their debit or credit cards to make purchases, and they also demand prompt processing of their transactions. Even seemingly insignificant hiccups can have far-reaching ramifications. It is critical to work with a payment processor that has a track record of securely, precisely, and quickly processing huge numbers of transactions.

The definition of “fast enough” is always evolving. Processing credit card transactions in less than two seconds is now normal practise for the industry.

Look for dependable uptime testing

Businesses suffer greatly when the payment system is disrupted. Your organisation is effectively out of business if your credit card processing system goes down. There are other ramifications than downtime. During a power outage, customers may leave your store because they think your business is insolvent or inconvenient. What type of brand association are business owners searching for, anyway?

Clear and understandable fee structures

A credit card processing service can be difficult, but its prices should be clearly communicated. Many factors determine the fees and charges you pay, including the exchange category that relates to your company’s business model.

The risk factors connected with various types of organisations cause fluctuations in exchange rates. Even while different payment processors charge their own fees and commissions up front, all processors in the exchange charge the same exchange fee.

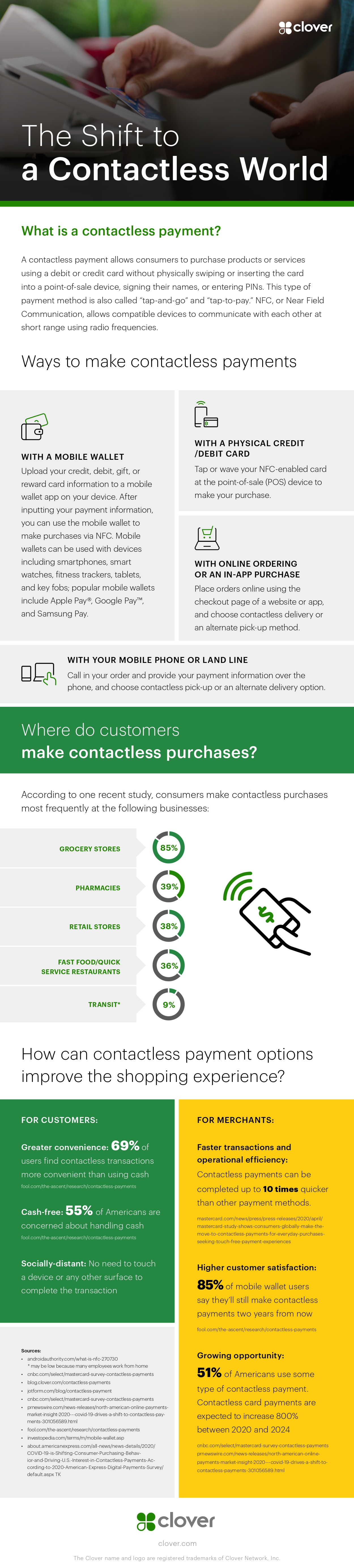

Infographic created by Clover Network, a retail POS system company